A currency converter API is a great tool for websites that operate internationally. It performs key functionalities that businesses rely on for accurate data. We’ll share the basics of how the technology works and provide the top use cases for currency exchange rates.

We’ll also share why starting with free APIs is the smart move for many websites and businesses. Choose the right one, and you’ll get many of the core features, which means you can save a lot of money.

Keep reading to learn more about API currency converter tools and what features are available.

Table of Contents

Currency Converter API: What Is It?

A currency converter API is a digital service that allows applications to retrieve and convert currency exchange rates in real time. The technology is typically used in financial, travel, and e-commerce applications. It enables accurate currency conversions across various currencies by accessing up-to-date data from global financial markets.

Furthermore, users or developers can integrate the API into their platforms to automatically calculate exchange rates. This makes international transactions seamless, and there’s no need to know a programming language.

Additionally, popular currency converter APIs offer additional features. Top examples include historical rates, multiple currency support, and real-time or delayed data feeds. Overall, it supports financial decision-making and enhances user experiences for businesses handling global transactions.

How Does a Currency Converter API Work?

Let’s cover the basics of how a currency converter API works to help you get a better idea of the technology. You’ll see there are a few moving parts that you need to understand about these tools.

1. Data Collection and Source Integration

Currency Converter APIs gather data from financial institutions, forex markets, and central banks worldwide to obtain the latest exchange rates. These APIs often aggregate multiple data sources to ensure accuracy and reflect real-time fluctuations.

Furthermore, they also pull historical exchange data, which offers a comprehensive database of rates over time. This information is periodically updated, sometimes every few seconds, minutes, or hours, depending on the API’s purpose and target user. For example, in a geocoding API, the information is updated frequently.

Furthermore, by centralizing data from trusted sources, currency converter APIs provide developers and end-users with a reliable source of global currency values.

2. Real-Time Conversion Process

When an application sends a conversion request, the API processes it immediately. This is done by retrieving the current exchange rate between the specified currencies from its database. Then, the API calculates the equivalent amount by applying the exchange rate to the specified amount. Essentially, this provides real-time conversion results to the end-user.

Furthermore, many APIs allow developers to set conversion options, like the base currency or adding fees. The tool automates this process, so the API eliminates manual calculations. It also ensures accurate and up-to-date conversions. Hence, applications can display the precise converted value within seconds of the initial request.

3. API Integration and User Requests

Developers integrate the currency converter API into their applications via API keys and endpoint URLs that the service provides. Users or applications then send requests using these endpoints and specify a number of details. Commonly, it includes the source and target currencies, and the amount to convert.

The API processes the request and returns data in a standard format like JSON or XML. This modular integration lets developers control when and how to display currency conversions. It allows for the customization of response formats and rate types to match specific business requirements.

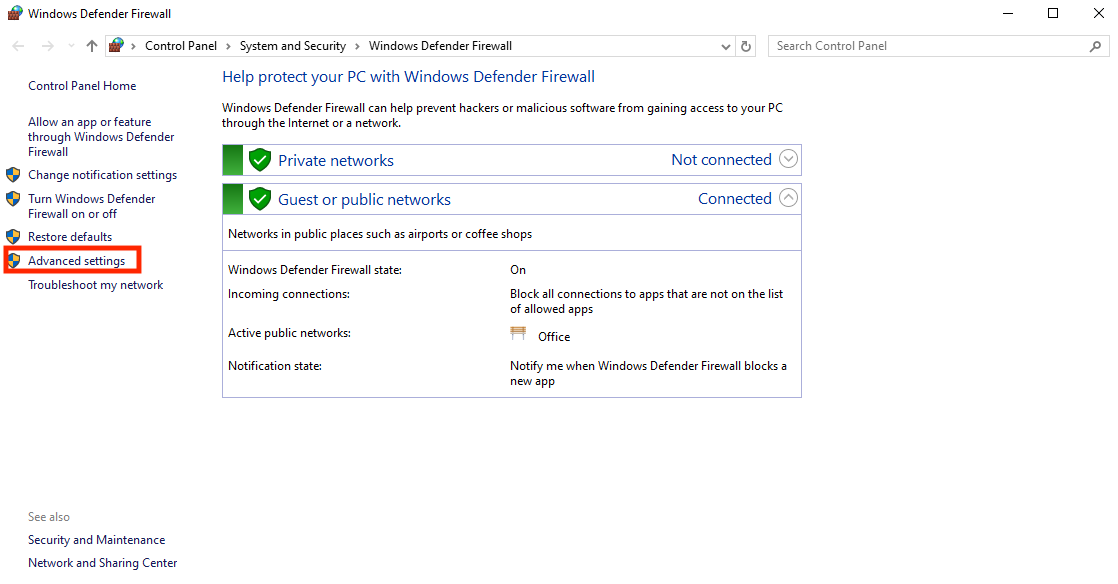

4. Security and Rate Limit Management

Currency converter APIs implement security measures, which include HTTPS encryption, to protect data and maintain secure communication. Additionally, APIs also use authentication keys to verify legitimate usage and often set rate limits. This controls how many requests an application can make within a specific timeframe.

The technology prevents excessive use that might overload the server or inflate operational costs. Additionally, these APIs may track usage metrics for each account to ensure both security and efficient resource use.

Managing usage and protecting data integrity enables currency converter APIs to provide reliable and scalable services.

Start With a Free Currency Converter API

A free currency converter API offers several benefits. This is especially true for small businesses, developers, and startups. Free APIs allow users to experiment with currency conversion features without incurring initial costs. Ultimately, it makes testing and prototyping easier.

It enables developers to integrate currency conversion capabilities into applications, websites, or e-commerce platforms without committing to paid plans. Also, users can familiarize themselves with the API’s features, request format, and response handling before scaling.

Free convert currency APIs often provide essential functionalities. Top examples include live exchange rates, basic currency conversions, and access to a limited number of currencies. They may also include rate limitations or restricted data update frequencies. However, these are typically sufficient for basic use cases.

Furthermore, using a free API reduces development costs. It also allows companies to gauge user demand for currency conversion features before upgrading. This supports quick deployments, as integration is usually straightforward with clear documentation.

Overall, free currency converters provide a low-risk entry point into currency data usage. Hence, they assist businesses in building globally aware applications and optimizing their financial processes for international customers. Once you need more features, you can move forward to annual billing.

Top Use Cases for Currency Conversion APIs

Let’s examine a few of the more popular use cases for currency conversion APIs. This may help you understand if using such an API is the right approach for our project. Here are the top use cases:

- Online marketplaces and eCommerce: These APIs allow e-commerce platforms to display product prices in the user’s local currencies. They enhance user experiences and reduce cart abandonment. Furthermore, they provide real-time and accurate conversions.

- Financial applications and investment platforms: The tools enable financial and investment platforms to provide users with current exchange rates. Hence, you can use them for international stock, forex trading, and cryptocurrency conversions. Also, it’s possible to integrate real-time data, thereby allowing these platforms to offer accurate insights.

- Travel and hospitality platforms: Travel websites, browsers with built-in VPNs, and apps can use currency conversion APIs to show users the cost of hotels, flights, and experiences. This transparency helps travelers make informed booking decisions, simplifies budgeting, and reduces confusion over fluctuating exchange rates.

Use geoPlugin for Currency Conversion

There are a number of important use cases for API currency converters. For some businesses, having access to such tools greatly increases revenue, profitability, and user experience.

When using a currency converter API for the first time, consider going with a free version. This allows you to test the features and figure out if it’s the right option for your business.

Are you unsure of which free converter to try? Then, consider selecting a free currency converter from geoPlugin. Our service offers a robust toolset, including IP geolocation services, that requires no software installation and is integrated with a wide range of applications.

Go to geoPlugin right now and see what’s on offer!

Frequently Asked Questions

Now, let’s take a peek at some FAQs to get a better understanding of what currency conversion APIs are all about.

What are the common use cases for a currency converter API?

Common use cases for currency converter APIs include e-commerce pricing, travel booking, financial trading, expense tracking, and invoicing. That’s because these APIs enable real-time currency conversion by supporting accurate financial insights across global markets.

Can I get historical exchange rates for currency conversion APIs?

Yes, many currency conversion APIs offer historical exchange rate data, thereby allowing users to view or analyze past rates for specific dates. This feature is valuable for financial analysis, historical comparisons, and understanding trends. It also supports data-driven decision-making in trading and financial planning.

How frequently do currency conversion APIs update data?

The frequency of updates depends on the API provider and plan. Some offer real-time updates every second, while others update rates every few minutes or hourly. The update frequency impacts the accuracy of high-frequency trading and real-time exchange data.